|

VERIBANC'S TRACK RECORD

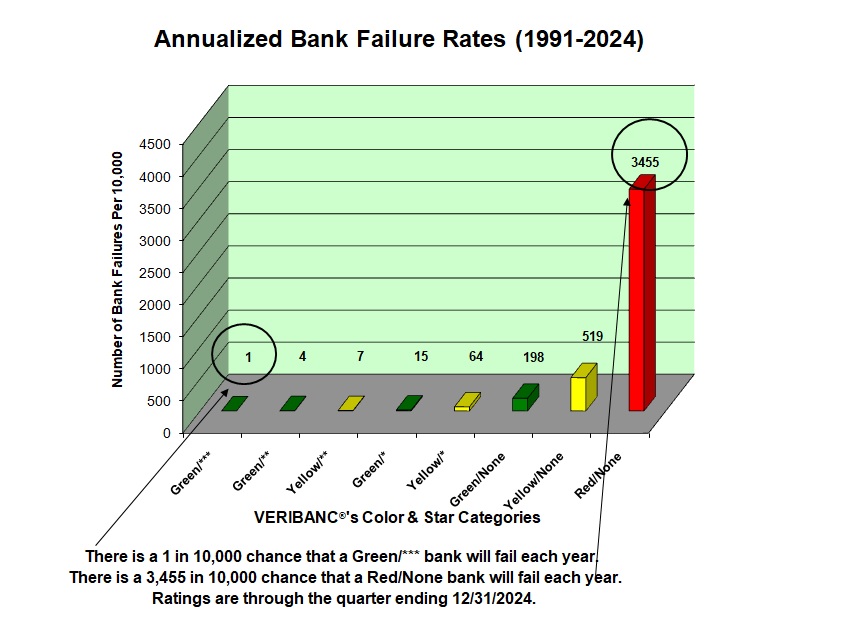

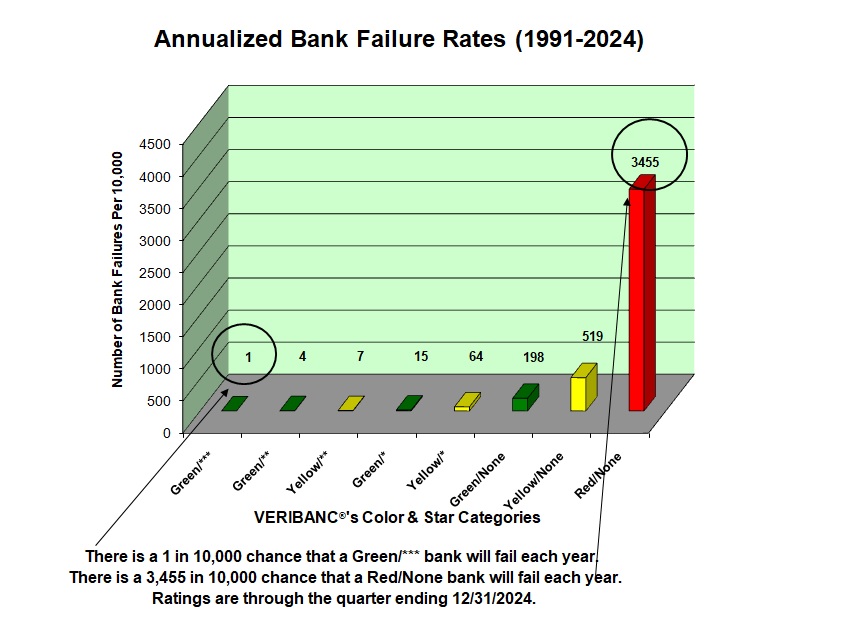

The accuracy of VERIBANC’s rating system is unmatched by any other company in the country. As an example of VERIBANC’s track record, all bank failures, since 1991, and their associated ratings as provided to clients are presented below. VERIBANC provides exact data on the accuracy of past ratings. No other bank rating service or credit risk rating agency tells you exactly how accurate their ratings are. Some bank raters selectively tell you about their successes.

VERIBANC believes that you should have enough information so that you can make up your own mind as to which bank to use -- and which bank rating firm to use. The ratings in the table that follows are the ones which were being furnished to VERIBANC’s customers before, and at the time, each bank failed. There are eight rating categories in VERIBANC’s system.

Please note that we do not claim to be perfect, just optimally tuned. Our rating system is unique in that we do not "conservatively adjust" our criteria so that a large part (30 percent or higher) of the banking industry winds up in our lower rating categories - so as to improve or inflate our predictive results. Instead we balance predictability of bank failure with false alarms, so we can provide our customers with true value. There is not much value in a rating system if over 30 percent of the industry has a lower rating - that is just not consistent with the average number of failures since 1991. Interestingly, please note that close to 80 percent of the industry received our highest rating of Green with Three Stars from 1991 through 2024. Our current ratings effectiveness rate is 98 percent, while our false alarm rate is about 20 percent. Ask our competition what their ratings effectiveness rate and false alarm rates are.

Average Number of Banks in Each Color Code and Star Classification

With Failure Rates Between 1991 and 2024

Color Code and

Star Rating |

Average No.

of Banks in

Each Category |

Average Percentage

of Banks in

Each Category |

Annualized

Failure Rate

Per 10,000

Banks/Year |

| Green/*** |

6,184 |

79.18 |

1 |

| Green/** |

628 |

8.03 |

4 |

| Yellow/** |

496 |

6.35 |

7 |

| Green/* |

258 |

3.30 |

15 |

| Yellow/* |

148 |

1.89 |

64 |

| Green/None |

7 |

0.10 |

198 |

| Yellow/None |

32 |

0.41 |

519 |

| Red/None |

58 |

0.74 |

3,455 |

Note that the combinations Yellow/***, Red/***, Red/**, and Red/* are not used.

Click here for RECENT FAILURES.

HIGHLIGHTS OF VERIBANC’s TRACK RECORD

Since 1991, most of the failures (826 bank failures) occurred among the Red, No Stars group which represented only 0.74 percent of the industry.

Only Two Failures, since our beginning in 1981, for Blue Ribbon Banks - Additional support for VERIBANC’s exemplary track record derives from the almost zero failure rate for banks receiving the Blue Ribbon Bank designation.

VERIBANC’s clients who have relied on Blue Ribbon Banks have had their risk of bank failure virtually eliminated.

Timeliness - Another factor which heightens rating effectiveness is timeliness. Each quarter, when new data for all banks is released by the Federal Reserve Board, VERIBANC is the first organization (often by several weeks or more) to make this information and our associated analyses available to the public. Why do we place such urgency on rapid updating? Quite simply because we have found that the latest indicators of an institution’s performance are the best predictors of how it will do in the future. Our studies have shown that a lot can change in three months. Some organizations do not associate a date with their information. As you might imagine, they are often “behind” -- by six months or more.

Adjustments To Ratings - VERIBANC ratings and analysis have been subjected to exhaustive external critique since 1981. We have invited review by observers ranging from industry experts to university researchers. Financial institutions are encouraged to contact us if they have more current data or unusual circumstances which they believe could or should affect their VERIBANC risk rating. We constantly monitor institutions and adjust, update and review ratings between quarters when appropriate. The purpose is to provide our clients with the best measure of banking risk that is possible.

It is because of our rating system’s unmatched track record that VERIBANC is considered to be the nation’s premier bank rating service.

CAUTION: If you use bank ratings from any other source, you need to know how reliable the ratings are and the data issue date on which they are based. Ask them for a copy of their track record and see what you get.

Thank you for your interest in VERIBANC.

If you have questions or would like to know more about our company or our reports and data sets, please:

Call 1-800-837-4226 (1-800-VERIBANc),

Mail to VERIBANC, Inc., PO Box 608, Greenville, Rhode Island 02828

Or, Email us.

We look forward to hearing from you.

|